Executive Summary

The 2024 Data Visualization Society (DVS) disseminated its annual State of the Industry (SOTI) survey was disseminated online between 2 September and 8 October 2024. Distribution mechanisms included an email announcement and series of reminders from the official DVS email address, an announcement in Nightingale (the DVS publication), a series of posts on the DVS Slack, and numerous social media posts (e.g., X, LinkedIn) from DVS and others (e.g., Meetup Groups). A total of 980 visualizers shared their perspective with us, with 763 filling out the entire survey.

As with previous versions, this DVS 2024 SOTI Survey Report is not a comprehensive review of the results; many details are left to the talented members of the DVS to explore in this year’s upcoming Survey Visualization Challenge. Below we provide high-level summaries of findings, analyze sensitive variables unavailable to the public, and answer important questions about the future of data visualization.

THE DATA

Who are we?

The 763 respondents to the 2024 SOTI survey include DVS members (46.5%) and non-members (52.2%) from 58 countries spanning all six populated continents [Figure 1].

Figure 1. Maps of Survey Respondents (counts)

Across countries, most respondents were from the United States, the United Kingdom, and Canada, who have held the top three spots each year (Figure 2). This year India, Germany, France, Russia and Australia (tied), The Netherlands, and Hungary round out the top ten, in order, slightly different than last year. The number of respondents after the top 3 countries is low.

Figure 2. Rank of Countries by Total Respondents (counts)

In addition to location, data visualizers are also diverse in the languages they speak. Over 1 in 3 respondents who answered this question identified languages besides English, and we collectively listed over 50 distinct languages [Figure 3]. Bubble size and color indicates the number of visualizers who identified speaking that language. The nine listed by the most respondents mostly match the past two years’ top listings: Spanish, German, and French, followed by Portuguese, Russian, Italian, Hindi, Chinese, and Swedish.

Figure 3. Non-English Languages Spoken by Data Visualizers (counts)

Interestingly, while 2024 respondents collectively listed fewer distinct languages, the proportion who identified as speaking non-English languages remains identical to previous years: 37% of all data visualizers who answered this question and 28% of everyone who took the survey.

Survey respondents represent many different backgrounds, experiences, and perspectives. Of the 674 respondents who answered the question about gender, 53.6% identified as women, 42.6% identified as men, and 3.9% preferred to self-describe. The survey also collected information on whether respondents identified as LGBTQIA+ and if they considered themselves a part of a historically disadvantaged or underrepresented racial or ethnic group; 27.0% identified as part of one or both groups [Figure 4].

Figure 4. Respondents Identifying as LGBTQ+ or from a Historically Disadvantaged or Underrepresented Racial or Ethnic Group (percent of respondents)

Among the 26 respondents who self-described their underrepresented group, most mentioned groups in the United States and a few identified as part of groups around the globe. Shape, size, action, or wheelchair status of icons are not meant to reflect survey respondents but included to demonstrate diversity in data visualizers.

Who are we?

DVS 2024 SOTI survey respondents reported living in 58 countries, speaking over 50 languages, and are a part of countless cultures from across the globe. We are men, women, and individuals who prefer to self-describe. One in four of us identify as part of the LGBTQIA+ community or from a historically disadvantaged or underrepresented racial or ethnic group or both.

What roles do we occupy and in what contexts do we work?

The 2024 survey received 763 responses to its opening question on data visualizer roles.

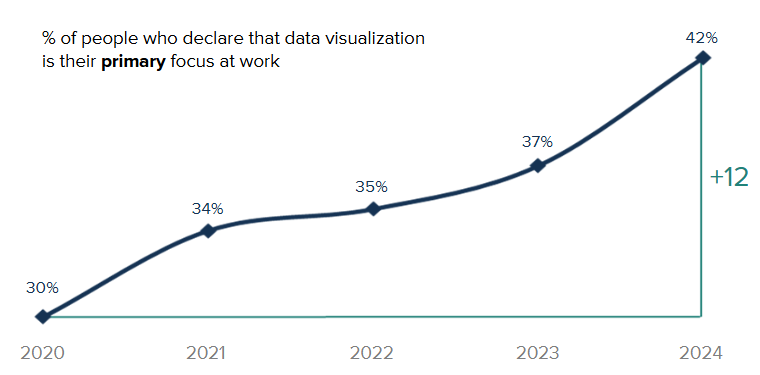

While some things about the way we work hasn’t changed that much in the past few years, the overall share of respondents who identify data visualization as their primary focus has continued to increase year-on-year starting at 30% back in 2020 and now at 42% this year [Figure 5].

Figure 5. Data Visualization as a primary focus (percents)

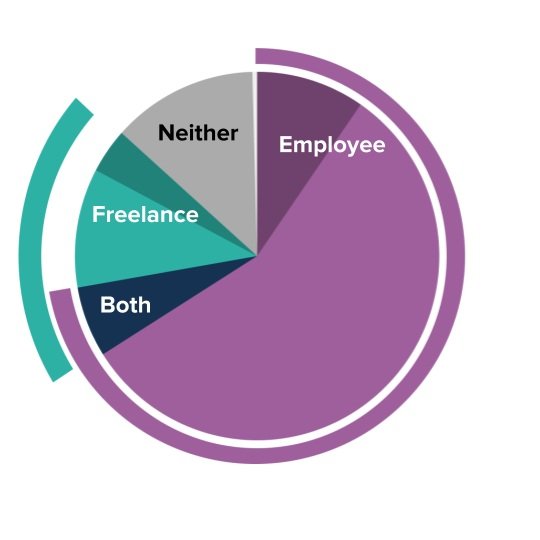

Echoing the past three years’ surveys, this question listed six options: four paid capacities plus two unpaid. The answers from 2024 closely match the distribution from previous years. As Figure 6 shows, the two most frequently represented—Employee (“Position in an organization”) and Freelance (“/Consultant/Independent contractor”)—were chosen by just over 3 out of 4 and 1 out of 5 data visualizers respectively.

Figure 6. Data Visualization in Mostly Paid Capacities (percents and counts)

Only 6% of respondents indicated that they do data visualization exclusively in unpaid capacities (as a Hobbyist and/or Student). This total is similar to the 6–8% of respondents who chose just Hobbyist or Student in the 2023, 2022, 2021, and 2020 DVS survey populations.

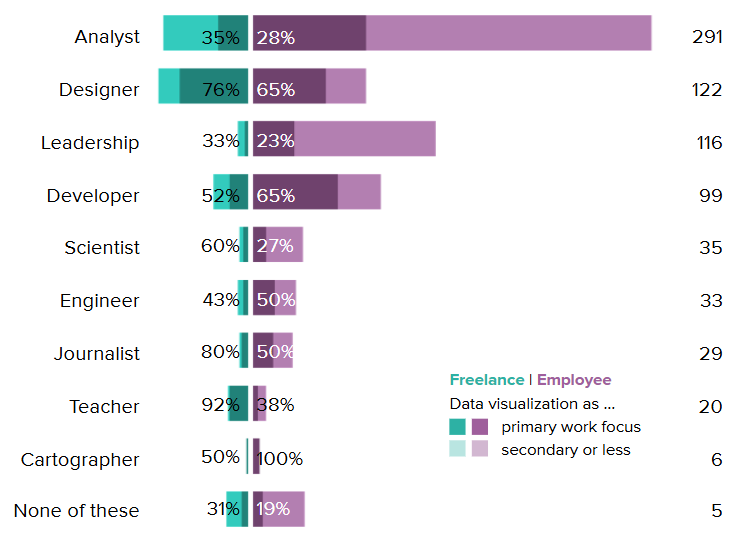

Respondents who chose Employee or Freelance were asked which of nine roles most closely aligns with their job and whether data visualization constitutes the primary focus of their work, an important secondary part, or neither. Figure 7 shows substantial variation by role type and some variation by employment context. Designers and Developers have the highest overall chance of doing data visualization as their primary focus. Among Analysts (the largest group, with nearly 300 respondents), just over 1 in 4 focus primarily on data visualization.

Figure 7. Primacy of Data Visualization by Role Type (percents)

The job titles that correspond to each role include data scientists, analysts, academics, and researchers; graphic designers, data storytellers, journalists, reporters, cartographers, architects, biologists, engineers specializing in machine learning, business intelligence, and software, and developers with experience on the frontend, with software, and for data visualization. We also heard from leaders at all levels, including team leads, managers, those of senior status, presidents, directors, chiefs, and founders. Notably, 22% of respondents indicated a job title containing the word “data,” 17% held a job whose title contained “analyst,” “analytics,” or “analysis,” and 10% reported a job title with some form of “visual” in the name (e.g., visualizer, visualization). Just under 10% had titles related to “research” or “design,” and slightly fewer were related to “developer” or “engineer.”

Respondents who chose Employee (“Position in an organization”) were also asked about the context (sectors and industries) of their organizations. Figure 8 shows how role types intersect with their identified organizational sector (top) and industry (bottom). Box size corresponds to the number of respondents at a given intersection. Analysts and folks in leadership roles are well represented across sectors and industries. There is relatively even distribution across industry categories included in the survey, but notably many respondents identified their industry as “Other” suggesting a breadth of industries to explore further.

Figure 8. Data Visualizer Roles by Sector and Industry (counts)

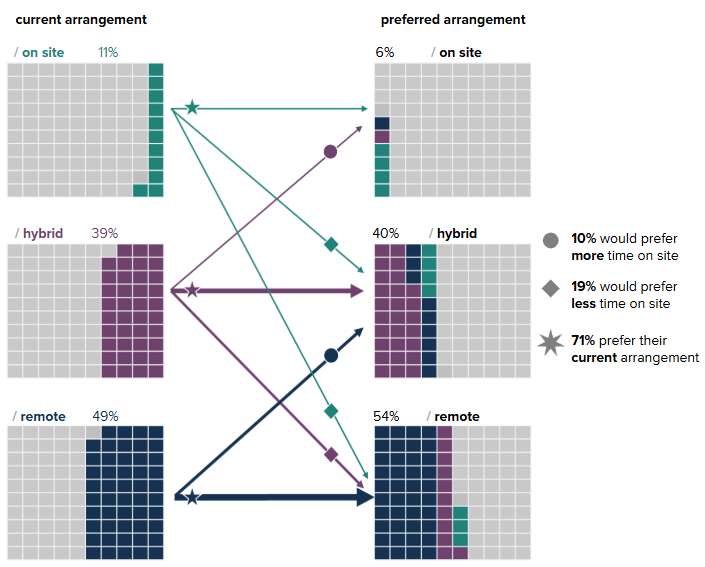

Knowing that where and how we work has changed dramatically in the past few years, we continue to track the situation data visualizers find themselves in and whether or not they are happy with their current work arrangement - be it on site, remote, or a mix of the two [Figure 9]. Half (49%) of survey respondents who answered a question about employment told us they are currently working remotely; around one in 10 are on site (11%); and four in 10 are working in a hybrid way (39%). While 71% told us that they like their current work arrangement (whatever it may be), 10% would prefer more opportunities to interact regularly with colleagues in-person, and 19% would prefer less. This has remained fairly consistent since we first asked in 2022 although the number saying they’d prefer less time on site has increased slightly since last 2023.

Figure 9. Current and Preferred Work Arrangements (percents)

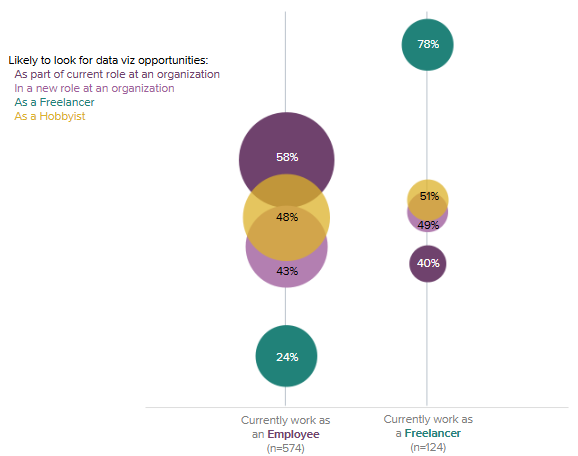

While the desire for a new working arrangement is relatively muted, there is an appetite to find new opportunities to do data visualization as part of their current job. Figure 10 illustrates a desire to stretch our data visualization wings but not necessarily in a brand new role. Six in 10 employees (58%) are likely to seek out data visualization opportunities as part of their current role, as are 8 in 10 Freelancers (78%) who are interested in opportunities that work with their role as a Freelancer. And while 4 in 10 employees (43%) and slightly more freelancers (49%) are interested in a new role at an organization, this road to more experience isn’t as appealing as gaining more data visualization experience as a hobbyist (48% of employees and 51% of freelancers).

Figure 10. Likelihood to Seek New Data Visualization Opportunities (percents)

What roles do we occupy and in what contexts do we work?

Respondents to the 2024 DVS SOTI survey represent a diverse array of fields, including the public sector, non-profits, academia, and freelance/consulting roles. Our job titles reflect the wide-ranging nature of our daily responsibilities and highlight the presence of data visualizers at all leadership levels. We work as analysts, designers, and developers across public, private, and non-profit organizations, spanning industries such as finance, marketing, and IT. Over the past few years, many have transitioned to new workplaces, and nearly three-quarters report satisfaction with their current roles.

How do we spend our time and how much do we make?

Each year of the survey we ask how many years of data visualization experience respondents have. The ridgeline plot in Figure 11 shows the increases in the proportion of more seasoned data visualizers over time. The highest proportion of respondents remains the same as in prior years: between six and ten years of data visualization experience.

Figure 11. Years of Data Visualization Experience over Time (percents)

Across years we continue to see the presence of folks within their first few years of data visualization. This consistent input of data visualizers new to our community suggests that there is still interest in joining this relatively new field. As we continue building our community, we also notice more folks in the higher years of experience categories. Looking at the changing distributions of data visualizers can help us understand what types of resources might be helpful. For example, a seasoned data visualizer may need different support than someone relatively new to the field, and vice versa.

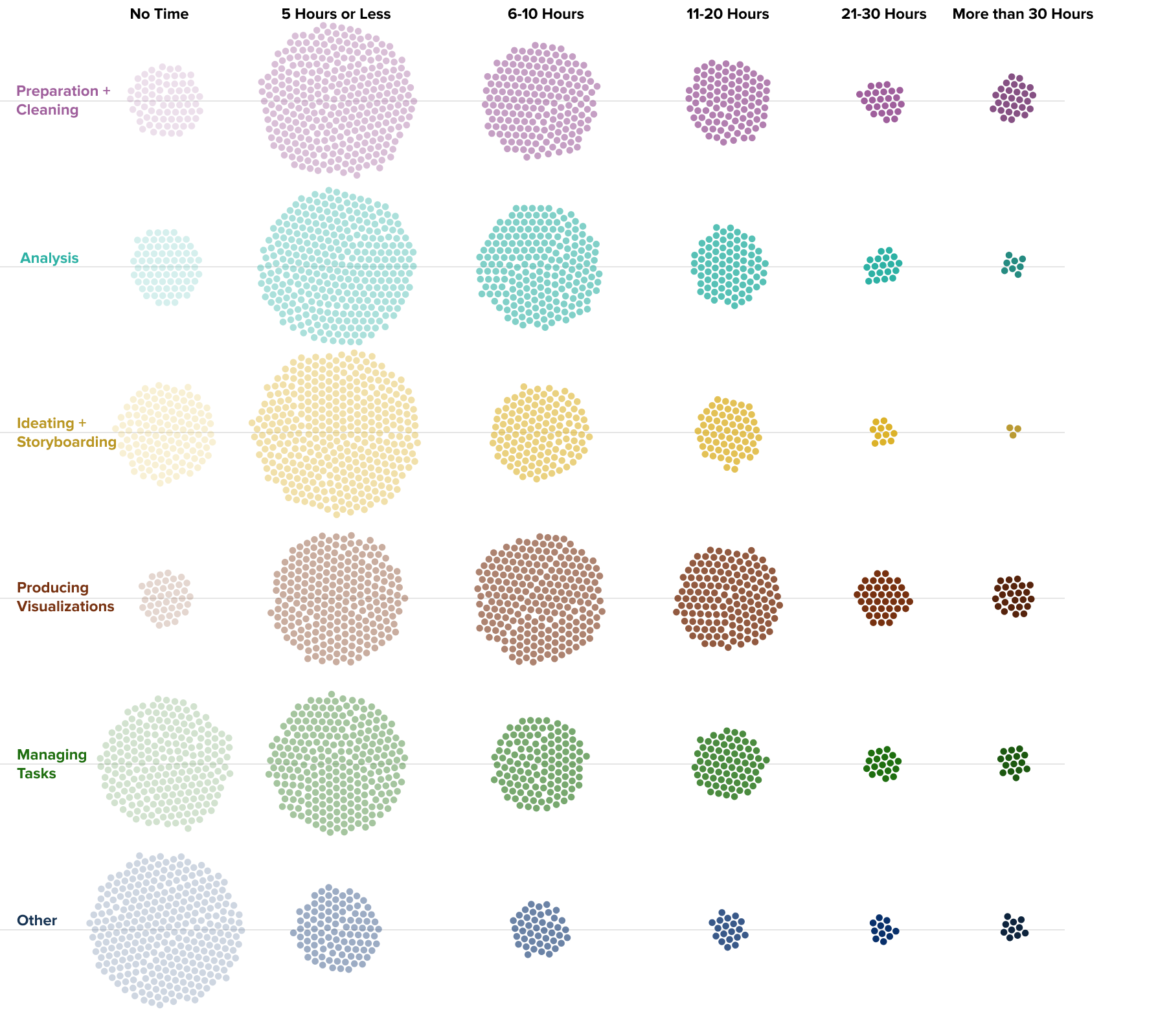

A key aspect of understanding someone’s data visualization practice is how much time they dedicate to different tasks. The beeswarm plot in Figure 12 highlights some of these activities. Most visualizers spend fewer than ten hours per week on any single task, often with no time at all on data visualization management. Respondents reported spending the most time producing visualizations; it has the highest proportion of participants spending 11 hours or more on the task, the same pattern we saw in 2023. In general, folks don’t report spending more than 30 hours per week on a given data visualization task, but for those who do, those hours are most often spent preparing and cleaning or producing data visualizations. Tracking and documenting how we spend our time is crucial to normalizing workflows and understanding what it takes to create high-quality visualizations.

Figure 12. Hours Spent on Data and Visualization Tasks (counts)

Transparency around compensation can help professionals establish their rates and advocate for what their time is worth. The overall median of the reported annual compensation is $80,000 to $99,999 (US dollars) per year, maintaining the salaries of respondents from 2023. Just over 3% of the 695 respondents who reported an annual salary indicated making $200,000 or above. The annual salary median does not differ across gender identities, identification as part of the LGBTQIA+ community, or identifying as a part of one or more disadvantaged or underrepresented racial or ethnic groups.

The data for hourly compensation in Figure 13 are similar in that very few folks are represented in the high income categories, though there are fewer respondents and a bit more variation across identity groups. The overall median hourly rate is $60 to $74 (US dollars) per hour. The median hourly compensation for women and those who preferred to self describe is lower at $45 to $59 per hour. No respondents from disadvantaged or underrepresented racial or ethnic groups reported hourly compensation above the $125 to $149 hourly range. Men, those who do not identify as LGBTQIA+, and those who do not identify as from an underrepresented racial or ethnic group are most represented in the higher rate categories.

Figure 13. Hourly Compensation by Gender, LGBTQIA+ Status, and Historically Disadvantaged or Underrepresented Racial or Ethnic Group (counts)

How do we spend our time and how much do we make?

Since the first survey in 2017, our community is becoming increasingly more seasoned. Most of us report cleaning data and producing visualizations for at least some time in the past week, these are also the data visualization tasks that have the most folks who reported spending more than 30 hours on. Collectively, we earn a median annual pay of USD $80,000–99,999 or an hourly rate of USD $60–74. Visualizers identifying as a woman, self-identifying their gender, identifying as part of the LGBTQIA+ community, or as part of a historically underrepresented group reported lower median hourly compensation.

How do we visualize and what challenges do we face?

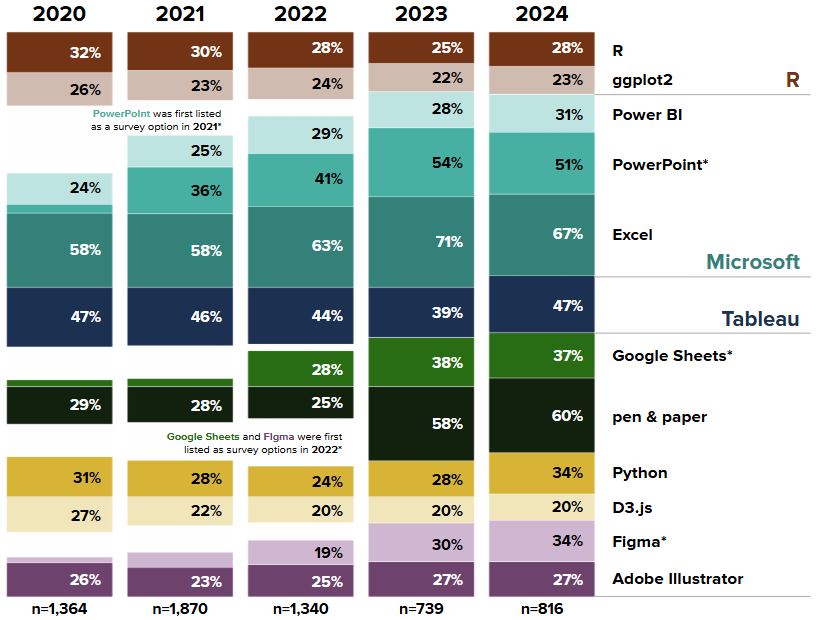

Many questions about how we visualize, including what tools respondents in particular roles or work contexts use, which chart types we use the most, and how we share our visualizations, can be answered with the public dataset through the forthcoming State of the Data Visualization Industry 2024 Challenge. Here we paint a broad picture of which technologies are used most for data visualization (Figure 14) and how much we enjoy the tools we use most often (Figure 15).

During each of the six years that the Data Visualization Society has conducted this survey, the tool used by the largest share of the respondents has been Microsoft Excel.

Figure 14. Technologies Most Used in 2024 Compared with Four Previous Years (percents)

From 2023 onwards, tool usage frequency was assessed with a single question offering 'Often', 'Sometimes', 'Rarely', and 'Never' for all tools, rather than a filtered list based on prior responses. Figure 14 shows the top twelve entries where respondents chose “Often” or “Sometimes”. As a whole, the results stay consistent from 2023 to 2024, with a few exceptions. Seven tools were chosen more often: Tableau (+8%), Python (+6%), Figma (+4%), R (+4%), Power BI (+3%), pen & paper (+2%), and ggplot2 (+1%). Three tools were chosen less often: Excel (-4%) saw its first decrease in percentage points this year, PowerPoint (-3%), and Google Sheets (-1%). D3.js and Adobe Illustrator stayed consistent at 27% and 20% respectively year over year.

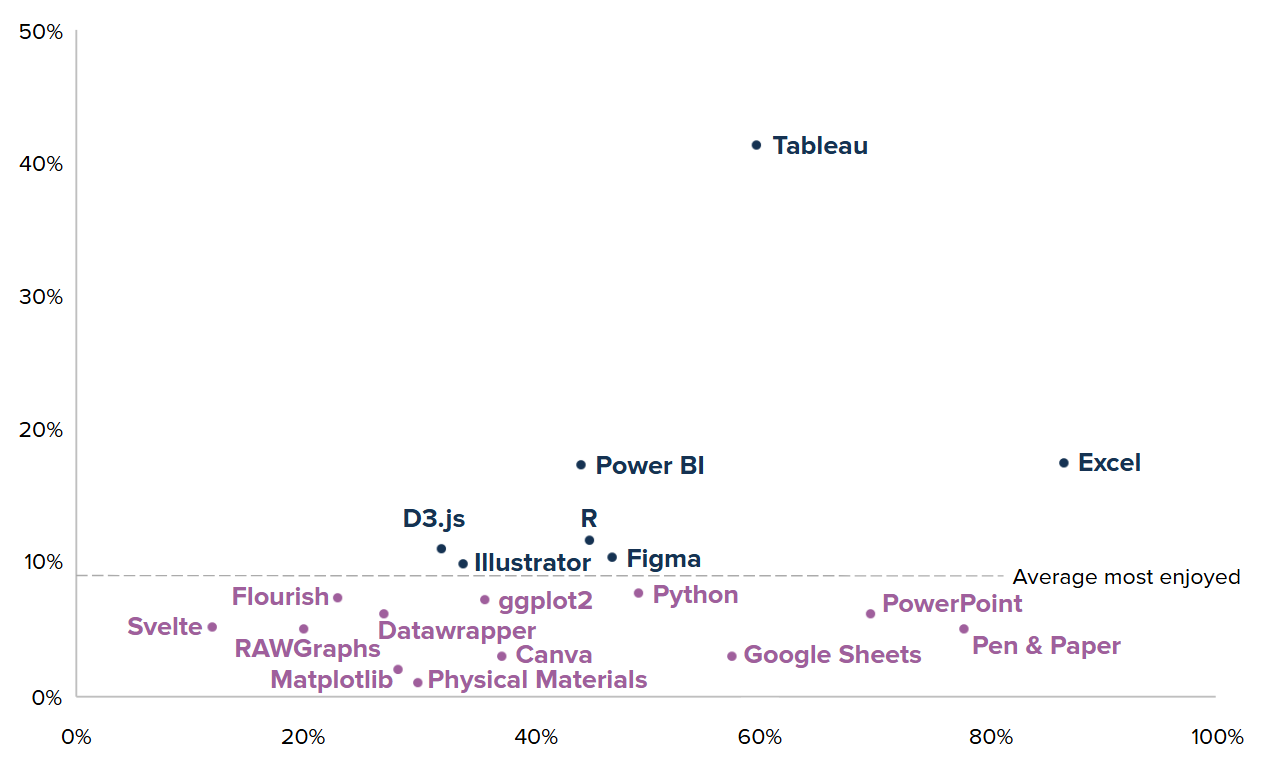

This was the third year the survey asked data visualizers how much they like the tools they use. Figure 15 displays how much data visualizers enjoy using specific tools relative to how extensively they are used. Each dot in the scatterplot represents one of 19 unique tools, combining the top 15 tools used most frequently and the top 15 tools enjoyed most, as reported by the 816 practitioners who responded to the tools questions.

Tools enjoyed at or above average (i.e., noted by at least 9% of the data visualizers who listed their three favorites) are represented in dark blue, while those falling below this average are indicated in plum. The preferences expressed by 2024 survey respondents are as follows:

Tableau is listed as a favorite for a second year in a row by 41% of respondents.

The next three favorites: Excel (enjoyed by 18%), Power BI (17%), and R (12%).

Rounding out the list of tools that ranked high for both frequency and enjoyment are: D3.js (11%), Figma (10%), and Adobe Illustrator (10%).

Figure 15. Enjoyment of Technologies Most Used in 2024 (percents)

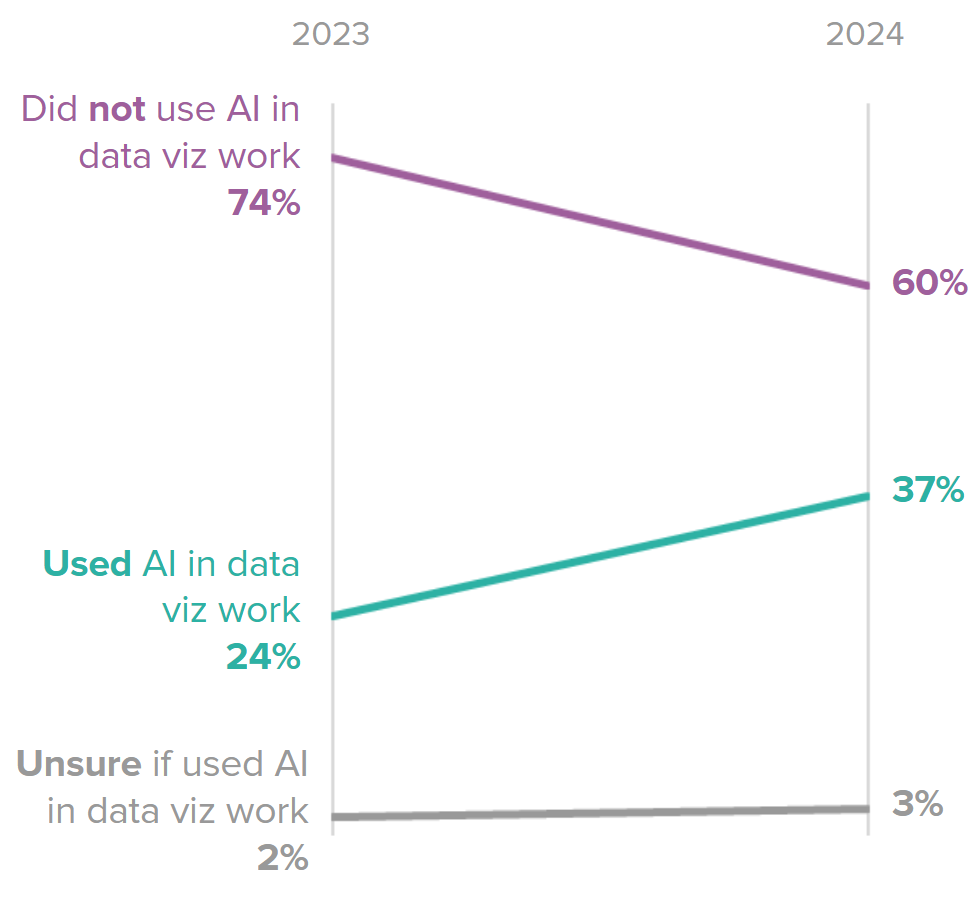

Artificial Intelligence (AI) technology is shifting much of how we work, including within the field of data visualization. This is the second year the survey asked data visualizers if they’ve used AI in their data visualization work in the past year (Figure 16). This year:

60% (492 people) did not use AI in their data visualization work. The percentage decreased by 14 percentage points compared with 2023.

37% (305 people) used AI in their data visualization work. The percentage increased by 13 percentage points compared with 2023.

3% (28 people) were not sure if they used AI in their data visualization work. The percentage increased by 1 percentage point compared with 2023.

Figure 16. Increasing Use of Artificial Intelligence (percents)

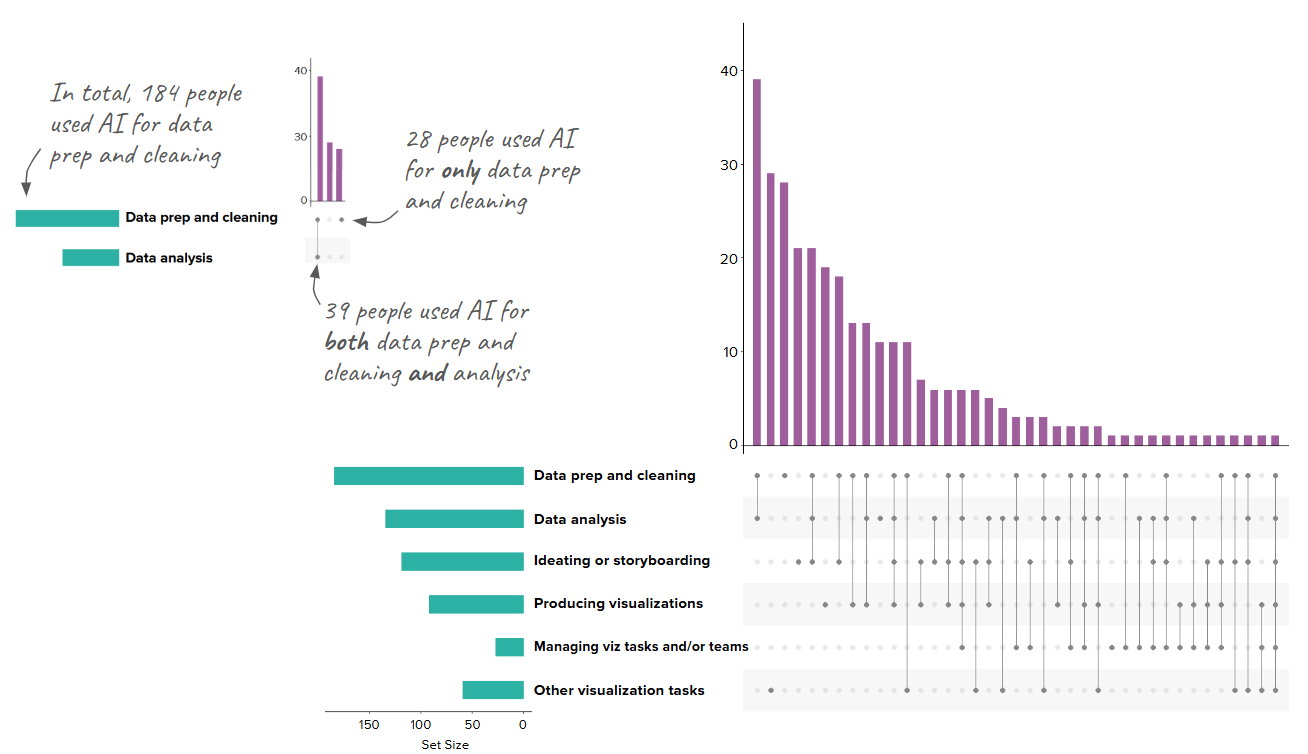

Among the 305 people who reported using AI in their data visualization work, the findings showed that the majority of respondents used AI primarily during the initial stages of the data lifecycle. As Figure 17 illustrates, most participants reported using AI for data prep and cleaning and data analysis (39 people). This is followed by participants who utilized AI for other visualization tasks (29 people), data prep and cleaning only (28 people), and ideating or storyboarding only (21 people).

Of the respondents who selected "Other visualization tasks," 23 provided write-in responses detailing their use of AI tools. Thematic analysis revealed four key themes: 1) coding assistance, 2) learning and ideation, 3) workflow efficiency, and 4) data visualization support. Many respondents highlighted using AI for coding assistance, such as debugging and generating code, with one participant stating, "I use AI (ChatGPT) to help me debug the code that builds the data viz - essentially saving myself time searching through help forums." Another prominent theme was learning and ideation, as respondents noted AI’s role in brainstorming and understanding new topics, exemplified by the quote, "I always learn from ChatGPT and plan to build a dashboard with its assistance." AI also supported workflow efficiency, with a respondent sharing, "It generates a lot of content quickly, helping me sift through ideas and save time." Finally, data visualization support emerged as a key area, with one respondent noting, "I primarily use AI to suggest titles, subtitles, and labels for my visualizations." These findings illustrate the diverse applications of AI in visualization workflows and the gradual integration of AI into the toolkit of data visualizers even in these early stages. It will be interesting to follow the development of AI tools and their potential impact on the future of data visualization.

Figure 17. Use of Artificial Intelligence (counts)

Respondents also indicated what challenges they face when doing data visualization (Figure 18) (n = 794). The most common challenge was lack of time, selected by 88% of visualizers who responded to this question. Learning new tools/approaches and technical limitations of the tools (both selected by 85% of respondents) were the next most commonly selected responses; technical limitations of the tools was not as big of a challenge in 2023 or 2022. Across all of the challenges, lack of time (34%), too much effort on non-viz activity (27%), and accessing data (22%) were rated as the most significant challenges, the same top significant challenges as 2023.

Figure 18. Top Challenges with Doing Data Visualization (counts)

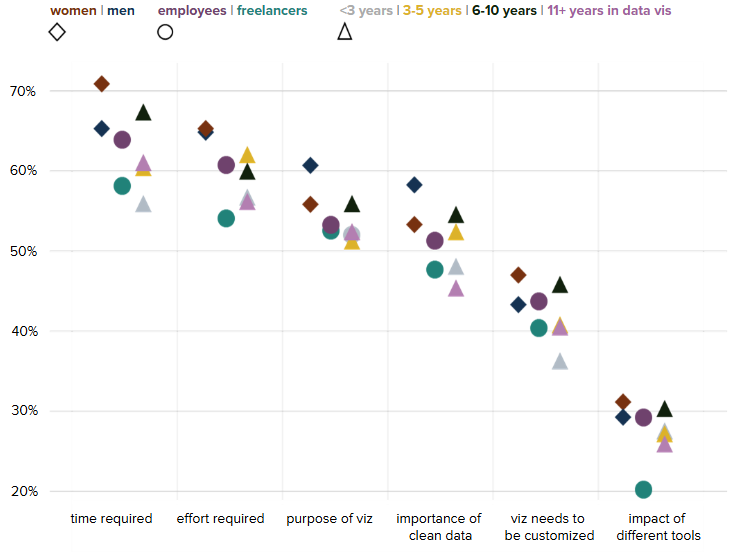

Those working in data visualization all have common frustrations when it comes to misunderstandings about challenges they encounter. First and foremost, six in 10 say it’s hard for non-practitioners to understand the time (62%) and effort (59%) required to complete a visualization from start-to-finish. Another half believe it’s hard for those they work with to understand that visualizations aren’t just decorative (53%) and they don’t understand the importance of clean data (51%). Relatively few feel that the impact of different tools on visualizations is difficult for others to understand (28%). Figure 19 shows that while these frustrations are relatively common across all groups, there are some differences based on gender, whether you’re working as an employee or freelancer, and how long you’ve been working in data visualization.

Figure 19. What’s hard to understand about data visualization work (percents)

How do we visualize and what challenges do we face?

DVS 2024 SOTI survey respondents use a lot of different tools to accomplish our data visualization tasks. Across the past 5 years, Excel, Tableau, R/ggplot, and PowerPoint have been some of the most popular tools, though respondents report dozens of unique tools annually. The past two years dashboard and spreadsheet tools were most liked. We have started incorporating AI into our data visualization workflow, though time will tell how that continues to evolve. We have primarily been applying AI in data visualization to early data lifecycle stages, such as data preparation, cleaning, and analysis, with some folks using AI to code, ideate, create workflow efficiencies, and support building visualizations. Outside of AI, we do find it challenging when tools are chosen for us (e.g., by clients, or because of IT restrictions) as some tools are not a good fit for the type of data or visualization task. As in previous years, our challenges with doing data visualization include not having enough time as well as technical limitations of tools, though there are many challenges that impact visualizers’ work.

How do we get better?

As with most professionals, data visualizers are looking to improve their current skills and acquire new ones; the survey includes questions every year to understand our preferred methods of learning, priorities for improvement, and use of professional development funds.

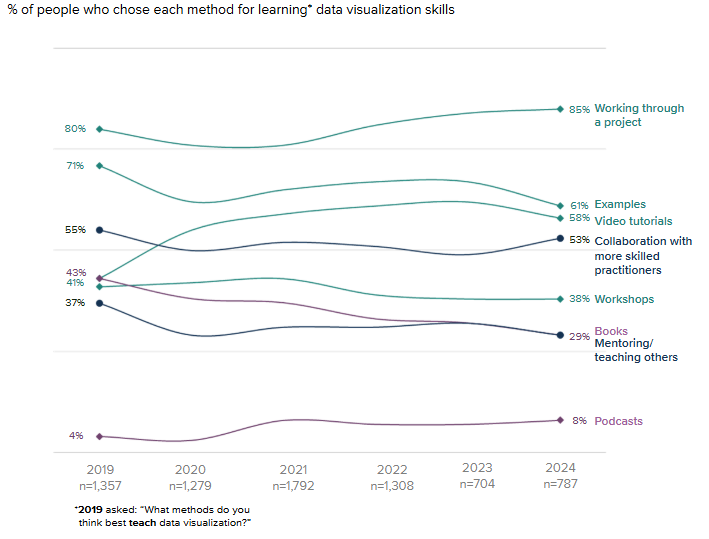

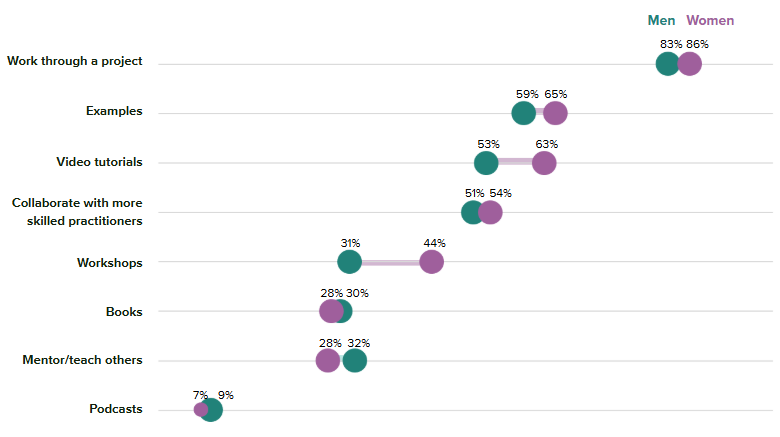

To learn new data visualization skills, respondents collectively reported that it would be most useful to “Work through a project” (85%) and engage with “Examples” (61%). As Figure 20 indicates, these two approaches have consistently topped the list through six annual surveys (although “Examples” has dropped off somewhat and is currently on a par with video tutorials).

Figure 20. Helpful Methods for Learning New Data Visualization Skills

(percents)

By contrast, “Books” continues to decrease in popularity and has dropped 14% points since 2019 when it was tied with “Video tutorials”. As in previous years, the relatively low ranking of “Workshops” on this list stands in striking contrast to their #1 position in Figure 23 on how data visualizers are likely to use professional development funds.

While visualizers identifying as men and women both continue to prefer “Working through a project” above all else, there are some interesting differences when we explore the rest of the data in Figure 21. Women have remained consistent in their preferences over the years but, men are less likely this year to prefer engaging with “Examples”, “Video tutorials” or “Books” but are more likely now to say they prefer to “Collaborate” with others. While this puts them more on a par with women in their current preferences, women are still more likely than men to prefer engaging with “Video tutorials” and “Workshops”.

Figure 21. Plans for Professional Development Funds Depending on Budget (percents)

*The n for respondents who indicated they preferred to self-describe their gender is too small to break down for further analysis.

The two most frequent write-in responses for “Other” this year continue to be blogs/online articles, and detailed documentation. Three other comments illuminated how respondents engaged survey wording about skills and collaboration: Collaborating with practitioners with complementary skill sets. Pertinent to questions of AI explored in Figures 16 and 17, another respondent wrote: Using AI for help and tips when working with code.

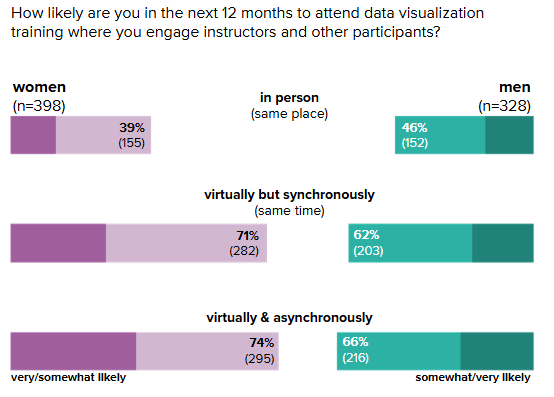

In nearly identical breakdowns as 2023, almost all (95%) respondents indicated an interest in continuing to improve their skills. When asked to pick one next priority, learning a new tool was the top response (32%). Getting better with an existing tool came next (25%), followed closely by design skills (22%), then data skills (12%), and “other” (3%). Other skills mentioned include: storytelling, analytical skills, and chart aesthetics. As in previous years, only 4% of respondents don’t feel they need to improve their data visualization skills. However, the likelihood to attend data visualization training in the next year has decreased since 2023.

Responses indicate that many more data visualizers think it likely that they’ll attend training virtually (just under 70%) than in person (42%). The difference between synchronous and asynchronous virtual options, by contrast, is fairly small (a difference of 3%). Comparing responses by gender in Figure 22 suggests that in-person training is preferred by slightly more men than women, while women are more likely to attend virtual training of either variety.

Figure 22. In Person or Virtual Training for Data Visualization (percents)

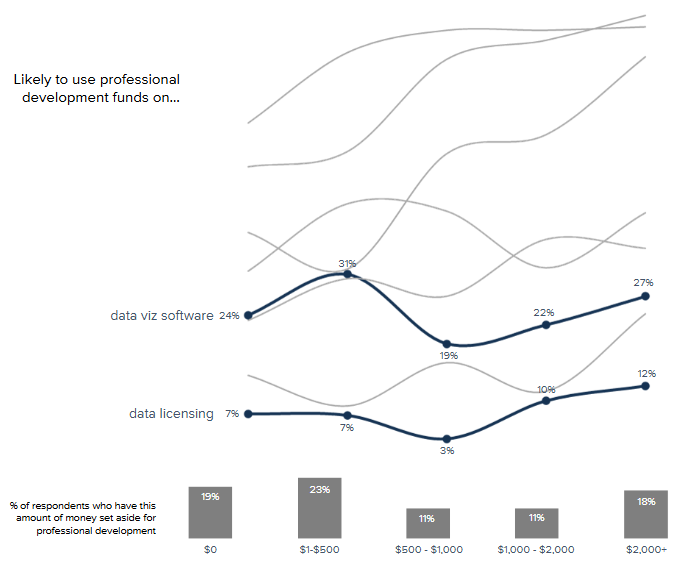

Skill building and development can also be facilitated through professional development opportunities and funding. Six in 10 survey respondents (58%) continue to have access to at least $1 in professional development funds and another 14% have $0 but still have professional development plans.

The type of activity survey respondents are interested in is still largely dependent on how much they have to spend, but priorities remain the same as last year. Not surprisingly, those with more to spend are still more likely to choose to budget for conference registration and travel/hotel. Workshops and books, on the other hand, are both most popular with those with less than $500 to spend.

Figure 23. Plans for Professional Development Funds Depending on Budget (percents)

Figure 23 shows the different events, activities, or other costs they would likely cover using professional development funds depending on how much they anticipate being allocated in 2024; respondents could select all activities or resources for which they would consider using funds.

How do we get better?

Data visualizers consistently strive to learn and grow, utilizing a variety of approaches to build our skills. As in the past three years, our top skill development priorities focus on mastering tools and design, with an emphasis this year on learning new tools. Many of us prefer hands-on learning through projects but also engage with other methods such as video tutorials, workshops, and collaborations. Virtual training, offered in both synchronous and asynchronous formats, remains a popular option for skill-building. When it comes to professional development funds, our priorities vary depending on expected budgets, though conferences and workshops are the most common areas of interest.

What do the data tell us about the future of the industry?

Each year we try to think about what the future holds for data visualizers. Encouragingly, when asked whether or not interest in data visualization is increasing or decreasing, over 6 in 10 believe it’s increasing (63%) and only 5% believe interest is waning.

Visualizers also acknowledge issues surrounding data visualization within the community and beyond (Figure 24). Over 75% of respondents rated each issue as at least “somewhat urgent.” The top three issues that were rated as “extremely urgent” were lack of data visualization literacy, designing for disabilities, and algorithmic bias. In 2023 the top two extremely urgent issues were the same (though in opposite order, with the third issue as the lack of ethical standards, ranked fifth this year. In 2021 and 2022, respondents indicated the lack of data visualization literacy, the lack of awareness of the impact of data visualization, and data visualization not having a seat at the table as key issues. These year over year differences might indicate a shift in concern to the biases inherent in AI, which more people are using for data visualization.

Figure 24. Top Issues Facing Data Visualization and Ratings of Urgency (percents and counts)

What do the data tell us about the future of the industry?

The top issues facing the data visualization community continue to shift across years, with lack of data visualization literacy, designing for disabilities, and algorithmic bias receiving the most ratings of extreme urgency to address. Further, nearly two-thirds of us believe interest in the data visualization community is increasing.

Suggestions for Further Exploration

This report evolves each year as we gain new insights about the community and determine what to prioritize sharing based on the data you provide. While we cover a lot within these pages, there is always more to explore, analyze from different angles, and uncover to share with the community. Each year we leave further exploration of the details and nuance of our community to people like you to explore in the Survey Visualization Challenge. We always love seeing what you do with the data - those of you who take the survey, those of you who admire it from afar, and those of you who will take it next year. Here are a few interesting ideas to get you started.

We’ve now collected eight years of data visualization industry data. These data are perfect for you to take a look at questions we routinely ask and see how the responses change over time. We have some examples of this in the report already, but consider how else you might analyze the data? What other stories can you tell about our community?

If something in the report piques your curiosity, dive into the dataset to explore the data from different angles. For instance, you might analyze how income varies by role or something more unconventional, like the types of charts or tools preferred by individuals at different income levels. We have more AI questions this year - what do those look like by role? Are freelancers using AI more or less than hobbyists? Than folks working as employees in an organization? There are countless exciting exploratory analyses to try, and you can even take it a step further by comparing your findings with data from previous years to see if the trends hold!

It’s your turn to discover the untapped insights in the free-response questions, with qualitative data from recent years awaiting exploration. This presents a fantastic opportunity for qualitative researchers to uncover patterns and themes, such as misconceptions about data visualization or the "other" tools and chart types that didn’t make the main list. Perhaps it’s time to experiment with an AI tool to help analyze and process these valuable community contributions!

The above ideas are certainly not exhaustive! What is interesting to you? What do you want to learn about our community and industry? As mentioned above, you have a great opportunity to explore the survey data by participating in the DVS State of the Industry Challenge. Each year we release a public version of the data and announce a challenge for members of the community to dive in and visualize something interesting. You don’t have to wait for that to be announced though - the data are also available outside of the challenge and we are definitely eager to see what you will find!!

Acknowledgements

The DVS Survey Committee, members of which thoroughly review and refine the survey items each year and compile this report, includes experts on data visualization, survey design, program evaluation, research, and consulting, among others. The DVS Survey Committee includes Jill A. Brown, Lisa Valade-DeMelo, Emily A. Borawski, Sheila B. Robinson, and DVS Programs Director Zane Wolf. Sheila, Lisa, Emily, and Jill collaborated on survey design updates; Emily completed the data cleaning and preparation; Lisa, Emily, and Jill contributed to the report visualizations and narrative.

References

Wee People Font Copyright (c) 2018 ProPublica and Alberto Cairo.